life insurance face amount and death benefit

The Level Death Benefit Option maintains a constant death benefit amount throughout the life of the insurance policy regardless of accumulated values andor premiums paid by the policy owner. The face value is typically how much your life insurance beneficiaries will receive if you die while your policy is in force.

Cash Value Life Insurance Life Insurance Glossary Definition Sproutt

Life insurance death benefit is the sum of money an insurer pays to beneficiaries upon your death provided the coverage was in force at the time of the event.

. Keep in mind that face amount and paid death benefits are similar. Ad No Exam Just Health Other Info. The face amount is the initial amount of money stated on the life insurance application when you first buy the policy and is intended to be paid as a death benefit to your heirs.

The first death benefit option is a level death benefit. The face value of life insurance is equivalent to the death benefit you select when purchasing a policy. How much is paid out.

Rates starting at 11month. The death benefit is the actual amount the carrier pays your beneficiaries and you can tack on additional benefits with riders. If you borrow money from the cash value of your whole life insurance then.

The death benefit can also be defined as the face value or face amount of a life insurance policy. FREE Quotes No Obligations. Face Amount vs Death Benefit.

Typical cash value targets will be 1 or to endow to be worth the initial face amount in cash at either age 100 or age 120. In this case the death benefit increases as the cash value does. Toggle menu toggle menu path dM526178 313114L447476 606733L741095 685435L819797 391816L526178 313114Z fillF9C32D.

The initial amount of money claimed by the beneficiaries on account of the death of the insured person that is mentioned in the contract is the actual face amount. Get an Instant Free Quote Online. Face value is calculated by adding the death benefit with any rider benefits and subtracting any loans youve.

The face amount is the initial death benefit on a life insurance policy. The death benefit is the amount of money that is paid out when a valid life insurance claim is filed. They both reflect the amount of money that the insurance company will pay out in the case of a valid claim.

You cant be turned down due to health. The first step in figuring out the face value of your plan is visiting your benefits schedule. Its the amount of death benefit purchased which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies.

If you decide for example you want to leave your loved ones with 200000 you apply for life insurance with a 200000 face value. The face value of a life insurance policy is the death benefit. Whole life the high quality ones age guaranteed to endow at age 100.

In all cases life insurance face value is the amount of money given to the beneficiary when the policy expires. Its typically paid in a lump sum but the policyholder can instruct the insurer to pay the death benefit in installments. You can also use the money to pay for your premiums.

A 500000 policy therefore has a face value of 500000. In most cases the death benefit is equal to the face value of the policy. Your beneficiary does receive the cash value in this case.

If you buy a 1 million life insurance policy your beneficiaries will receive a 1 million lump sum. The death benefit is the actual amount the carrier pays your beneficiaries and you can tack on additional benefits with riders. Ad Get an instant personalized quote and apply online today.

So if you buy a policy with a. However just because the amount of coverage. The death benefit is used to provide income for those that rely on the insured.

Call a licensed expert. The face value does not always equal the death benefit particularly when you are dealing with permanent coverage such as whole life insurance that has accompanying riders such as PUA riders and term riders and also has life insurance dividends. At the beginning of the policy the face value and the death benefit are the same.

However as time. No Medical Exams Needed. Options start at 995 per month.

This often goes by the name death benefit option A or 1. We recommend a death benefit amount of 10 to 15 times your annual income. How much and a what age.

The face amount is the initial amount of money stated on the life insurance application when you first buy the policy and is intended to be paid as a death benefit to your heirs. How Life Insurance Face Amount and Death Benefits are Calculated. Face value is different from cash value which is the amount you receive when you surrender your policy if you have a permanent type of life insurance.

When a life insurance policy is identified by a dollar amount this amount is the face value. It can also be referred to as the death benefit or the face amount of life insurance. But as the cash value of the policy changes over time it can alter the total death benefit either above or below the face.

Home Answers what is the difference between the face value and death benefit in whole life policy Asked July 10 2015. This type of policy tends to be more expensive since your cash value isnt used to offset insurance costs. The death benefit of a life insurance policy represents the face amount that will be paid out on a tax-free basis to the policy beneficiary when the insured person dies.

For example if you take out a 250000 life. Insurer will absorb the cash value of your whole life insurance policy after you die and your beneficiary will get the death benefit. The death benefit amount paid out is the coverage amount you choose when you buy your policy.

No Visits to the Doctor. A death benefit is a payout to the beneficiary of a life insurance policy when the policyholder dies. This death benefit equals the cash value plus the death benefit your policy was issued with.

The Actual Purpose Of Life Insurance Is A Death Benefit. Enough to cover a variety of situations including end-of-life. Your policys death benefit is the same as your policys face amount and vice versa.

You can borrow or withdraw money from your life insurance policy. The death benefit is paid to the stated beneficiaries of the contract which are determined by the owner before the insured person is deceased. April 30 2021.

Permanent life insurances face amount is the death benefit paid to your beneficiaries and the cash value is a separate amount that you can use while youre still alive. The death benefit amount is determined when you first buy the policy and in many instances is equivalent to the face amount or face value. Ad Compare Top Life Insurance Carriers Get You and Yours Covered.

In recent years many. Apply for guaranteed acceptance life insurance. The face amount of a policy is the amount you request when you apply for life insurance.

A structure of an increasing death benefit UL and cost will depend on the assumption of the target case value. How the Face Value of Life Insurance Works. The death benefit of your life insurance policy is just a technical term for face amount.

:max_bytes(150000):strip_icc()/lifeinsurance-v32-8e01fd19793a49699e47973cfdf98f3d.png)

Life Insurance Guide To Policies And Companies

Single Premium Endowment Plan Life Insurance Facts Life Insurance Corporation Life Insurance Agent

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

Pin On Insurance Marketing Humor Estate Planning Chronic Critical Illness Annuities Tax Savvy Make Money

:max_bytes(150000):strip_icc()/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Pin On Infographics Pinfographics

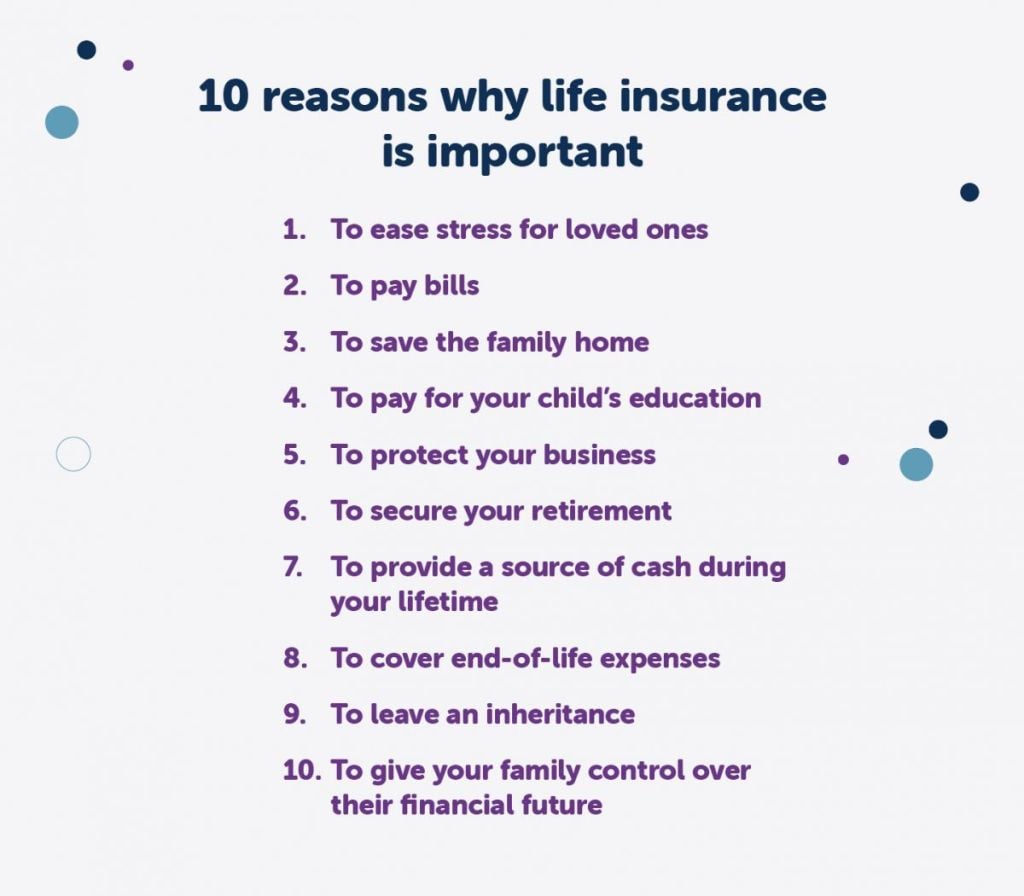

Benefits Of Life Insurance Need For Life Insurance Icici Prulife

Why Is Life Insurance So Important Fidelity Life

Pin On Infographics Life Insurance

You Have Heard About Life Insurance And You Know It S Important But What Does It Really Mean Let S Find Out In Simplifying Life Life Insurance Policyholder

Whole Life Insurance Life Insurance Glossary Definition Sproutt

Flowchart Should I Buy Insurance Infographic Home Insurance Quotes Insurance Sales Insurance Marketing